The background fundamentals are right for hospitality deals to start flowing but elements of the finance term sheet continue to prove frustrating to the vast majority of investors, according to the results of the latest Hospitality Investor Sentiment Survey.

Overall, Q2 2023 was the most positive set of responses to the survey since it was relaunched, recording a marginal increase of 3.7 pts from last quarter, to 51.9, with a score of +50 signaling an increase in confidence.

“The overall index score tipping into positive territory is a clear signal of increased optimism from the Investor Council as operational fundamentals continue to improve and there is an expectation of increased hospitality returns,” said Joe Stather, market lead for Questex's operational real estate portfolio.

“However, with a further interest rate rise this quarter as inflation remains stubbornly high, investors relying on debt are going to be sidelined; meanwhile all-equity investors are in pole position to take advantage of any opportunities which come to market.”

On the eve of IHIF (International Hospitality Investment Forum) in Berlin, and in spite of the Hospitality Investor Sentiment survey edging in to more positive territory, the results this quarter are a stark reminder that investors are still figuring out ways to unlock a regular and reliable deal flow after several years of post-pandemic frustration.

You can download the full report here.

Profit performance outlook is positive

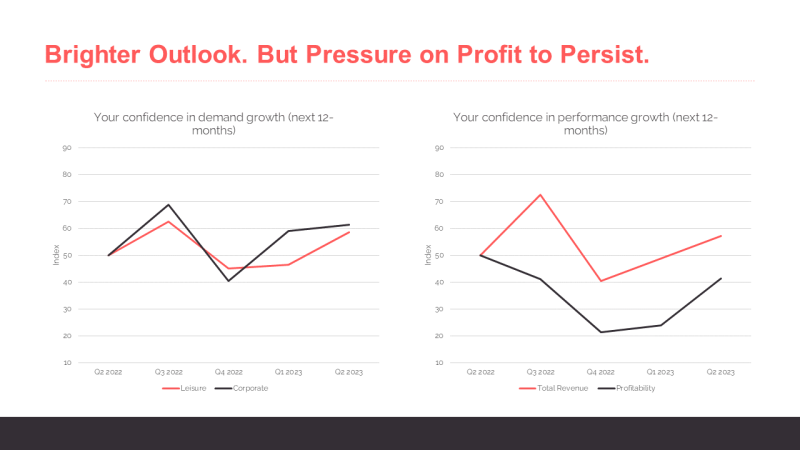

The Investor Council were very positive on the fundamentals of the operation in Q2 2023, expressing confidence in hotel performance in the next 12 months reflected in an uplift in the index score for revenue growth (+8.3pts) and profit growth (+17.6pts).

This is on the back of a period of robust recent growth in hotel revenue as well as costs finally stabilising, but also potentially due to a resignation from hotel operators that, when it comes to managing the cost profile of a hotel, it’s time to just accept the ‘new normal’.

This will result in robust growth in long-term accommodation demand over the next 12 months, with the index score hitting a punchy 71.4 this quarter, up by 4.4pts.

The positive responses on top and bottom-line performance are also on the back of a renewed confidence in growth in demand from both the leisure (+12.0pts) and corporate (+2.3pts) segments, which should fuel growth across all hotel revenue centres (Food & Beverage, Meetings & Events, Leisure), not just bedrooms.

This more positive holistic view of the operation has led our Investor Council to expect their investment focus to return to full-service hotels in order to make the most of the range of opportunities to capture customer spend and generate ancillary revenues.

The interest of our Investor Council in alternative accommodation types remains resolute at an index score of 64.3 in Q2 2023 and the dedicated adjacent spaces segment at IHIF will explore the explosion in popularity of the evolution of alternative hospitality real estate assets.

This has led to a number of the big players starting to make moves, with Goldman Sachs reportedly investing up to €200 million in three coastal resorts in Greece, Melia and ADIA closing on a JV in Spain worth €1 billion, and Blackstone announcing the final close of its Blackstone Real Estate Partners X fund, with $30.4 billion of total capital commitments.

However, it’s not that simple for everyone and for those that rely heavily on debt, as interest rates continue to creep so does the hurdle rate, resulting in the index score for total cost of capital increasing to 77.1 in Q2 2023, which is 9.6pts above the response in Q3 2022.

But only the green means go

Although the Investor Council expect that the price of debt is perhaps is due to stabilise, , they also made it clear that the constant frustration with finance meant the use of leverage has dropped by 12.0pts, to an index score of just 30.0.

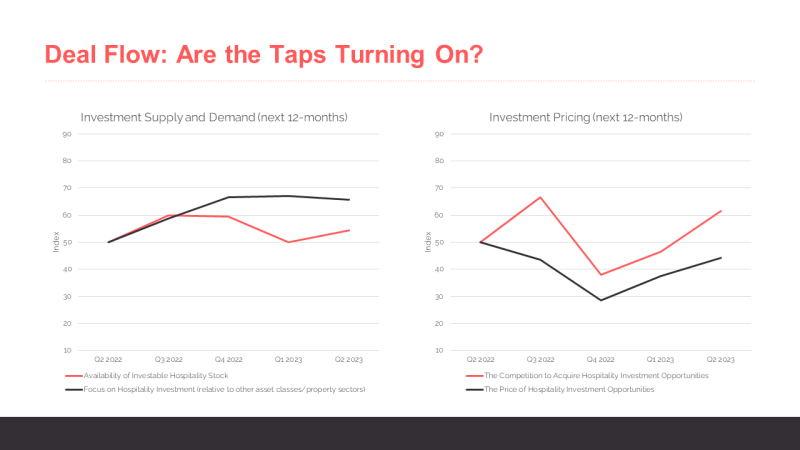

As well as the challenges in the lending market, the Investor Council cited the competition to acquire, and the price of, hospitality investment opportunities, as major hurdles to investment in the Q2 2023 survey.

The expectation, or perhaps hope, of those surveyed is that prices will fall in the next 12-months. We understand that formal valuations are now crystalising a decrease in values more generally, and this may soften seller expectations which have so far remained resolute. Ultimately, this could break the deadlock in deal flow, notwithstanding any stress or distress from refinancings.

But the patience in returns from the sector is starting to wane for some hospitality investors, with 15 percent of value-add investors stating that they are now looking at other asset classes/property sectors due to frustration with the segment.

As Joe Pettigrew, CCO Hotel Asset Management at Starwood Capital put it: “When you try to take the yield of your investment, versus the cost of debt, and then also the cost of construction, and the refurbishment and PIP, a lot of these numbers are not really translating, at least for somebody like us, to have been making big deals yet.”

However, the results of the Hospitality Investor Sentiment Survey suggest it now won’t take much to unlock the markets from their current position of glacial recovery in liquidty.